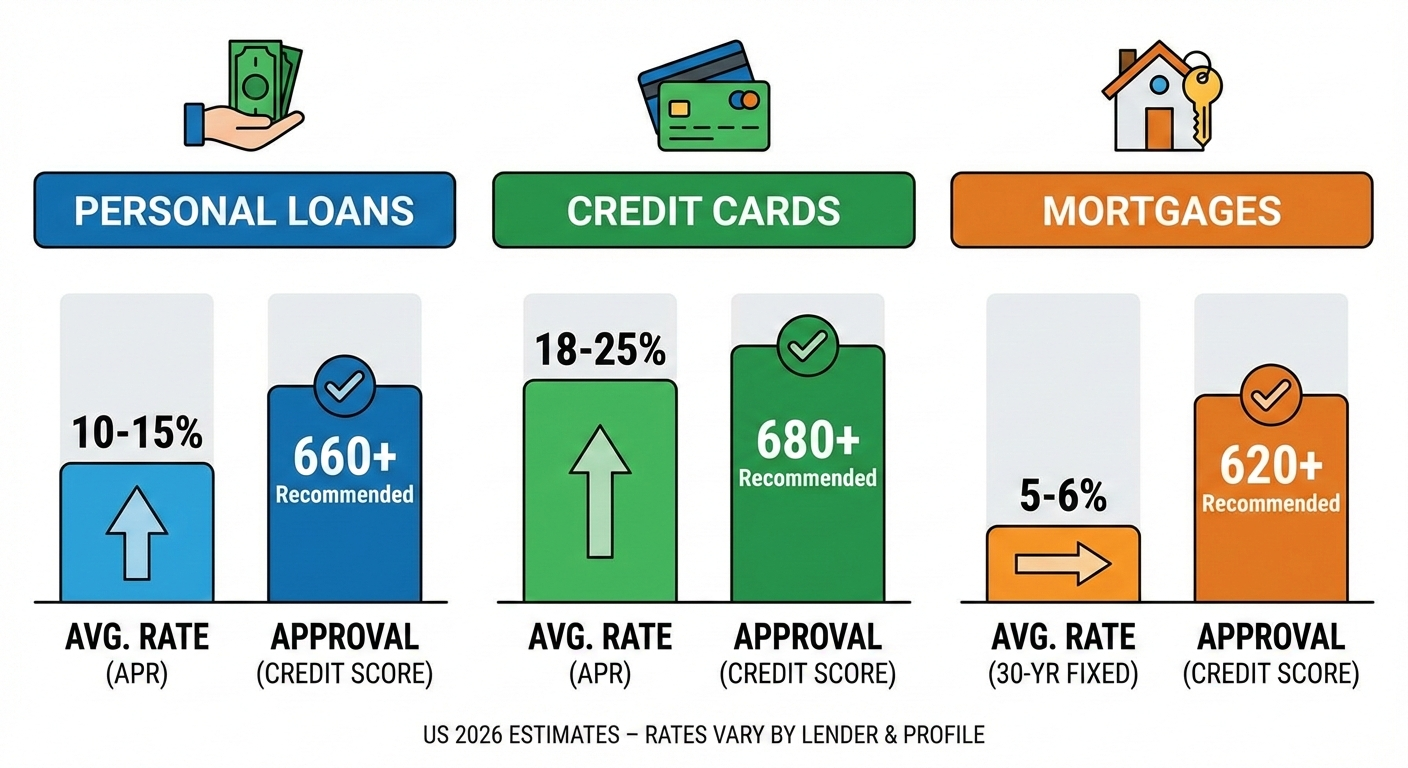

Personal Loans, Credit Cards, and Mortgages in USA 2026: Complete Guide to Interest Rates, Approval Requirements, and Smart Borrowing Strategies

Mortgage Rates Drop Below 6.1%, Credit Card APRs Hover Near 24%, Personal Loans Average 12.3% as Americans Navigate Complex Lending Landscape

NEW YORK — American consumers face a dramatically shifting landscape for borrowing money in early 2026, with mortgage rates falling to multi-year lows while credit card interest charges remain stubbornly elevated near record highs. Understanding the current state of personal loans, credit cards, and mortgages has never been more critical for millions of Americans making major financial decisions.

As of February 2026, the average 30-year fixed-rate mortgage sits at 6.11%—down significantly from 6.89% a year ago and representing the lowest rates since 2022. Meanwhile, credit card APRs average a painful 23.79%, and personal loan rates hover around 12.27% for qualified borrowers.

This comprehensive guide breaks down everything American consumers need to know about these three essential financial products in 2026, including current rates, approval requirements, insider strategies for getting the best terms, and critical warnings about costly mistakes to avoid.

Mortgage Rates February 2026: The Complete Picture

Current Mortgage Interest Rates Hit Multi-Year Lows

The mortgage market has delivered welcome relief to American homebuyers and homeowners considering refinancing after years of punishing high rates. According to Freddie Mac’s Primary Mortgage Market Survey released February 5, 2026, mortgage rates stand as follows:

30-Year Fixed-Rate Mortgage:

- Current Rate: 6.11% (as of February 5, 2026)

- Previous Week: 6.10%

- One Year Ago: 6.89%

- Change from 2025: Down 78 basis points (0.78%)

15-Year Fixed-Rate Mortgage:

- Current Rate: 5.50%

- Previous Week: 5.49%

- One Year Ago: 6.05%

Alternative data sources show slight variations in average rates:

- Zillow: 5.99% (30-year), 5.37% (15-year) as of February 6

- Bankrate: 6.23% (30-year) as of February 5

- Fortune/Optimal Blue: 6.098% (30-year) as of February 5

Sam Khater, chief economist at Freddie Mac, noted: “For the last several weeks, the 30-year fixed-rate mortgage has remained at its lowest level in years. The combination of improving affordability and availability of homes to purchase is a positive sign for buyers and sellers heading into the spring home sales season.”

Why Mortgage Rates Are Falling in 2026

Several converging factors explain the decline in mortgage rates from their 2023-2024 peaks:

Federal Reserve Policy: The Federal Reserve cut interest rates three times in the final months of 2025 (September, November, and December), bringing the federal funds rate from 4.25%-4.50% down to 3.5%-3.75%. While the Fed paused rate cuts at its January 2026 meeting, the cumulative effect of 2025’s cuts continues rippling through the mortgage market.

Mike Fratantoni, senior vice president and chief economist for the Mortgage Bankers Association, stated: “We expect that this level of rates will help support a somewhat stronger spring housing market than last year, but not a breakout year.”

Government MBS Purchases: The current administration proposed injecting approximately $200 billion into mortgage-backed securities (MBS) purchases. This government intervention aims to narrow the “spread” between mortgage rates and Treasury yields, effectively subsidizing borrower costs.

Economic Uncertainty: Weaker-than-expected employment data in recent months has reinforced expectations that the Fed will maintain accommodative monetary policy, supporting lower mortgage rates.

Reduced Inflation Pressures: Inflation has cooled considerably from 2022-2023 peaks, removing upward pressure on interest rates across the economy.

Mortgage Purchase Rates vs. Refinance Rates

Importantly, rates differ significantly between purchase mortgages and refinance loans:

Purchase Mortgage Rates (February 2026):

- 30-year fixed: 5.99%-6.23% average

- 15-year fixed: 5.37%-5.50% average

Refinance Mortgage Rates (February 2026):

- 30-year fixed: 6.53%-6.75% average

- 15-year fixed: 5.57%-5.67% average

The gap between purchase and refinance rates typically ranges from 0.3% to 0.5%, reflecting lenders’ perception that refinance loans carry slightly different risk profiles.

Who Should Consider a Mortgage in February 2026?

First-Time Homebuyers: With rates under 6.1% for 30-year fixed mortgages, affordability has improved significantly compared to 2023-2024 when rates exceeded 7%. Combined with stabilizing home prices in many markets, conditions favor buyers willing to act before spring competition intensifies.

Homeowners Considering Refinancing: Financial experts traditionally recommend refinancing when you can secure a rate at least 1 percentage point lower than your current mortgage. With rates at 6.53% for 30-year refinances, homeowners with rates above 7.5% should seriously consider refinancing.

However, those with existing rates below 6% should think carefully before refinancing, as the modest savings may not justify closing costs (typically 2%-5% of loan amount).

Homeowners with ARMs: If you have an adjustable-rate mortgage (ARM) scheduled to reset in 2026, locking in current fixed rates could provide long-term payment stability and protection against future rate increases.

Mortgage Rate Forecast: Will Rates Go Lower?

Expert predictions for mortgage rates through 2026 vary, but most forecast continued stability with potential modest declines:

Optimistic Scenario: If inflation continues declining and unemployment rises, the Fed may resume rate cuts in spring 2026. This could push 30-year mortgage rates into the 5.75%-6.0% range by summer.

Pessimistic Scenario: Unexpected inflation resurgence or geopolitical shocks could reverse recent progress, potentially pushing rates back above 6.5%.

Most Likely Scenario: Rates remain range-bound between 5.9%-6.3% through Q2 2026, with spring homebuying season competition potentially causing temporary upticks. Industry forecasters predict rates finishing 2026 around 6.0%-6.2%.

Credit Card Interest Rates 2026: Record Highs Persist

Average Credit Card APRs Remain Painfully Elevated

While mortgage rates have fallen substantially, credit card interest rates tell a vastly different story. American consumers carrying credit card balances face some of the highest borrowing costs in history.

Current Average Credit Card APRs (February 2026):

According to multiple tracking sources:

- LendingTree: 23.79% average APR (January 2026)

- WalletHub: 22.35% average for new offers

- Federal Reserve (November 2025): 20.97% for all existing accounts

- Bankrate Projection: Expected to reach 19.1% by year-end 2026

Accounts Actually Assessed Interest: For the 46% of Americans who carry balances and pay interest, the average rate is even higher: 22.83% as of January 2, 2026.

Credit Card Rates By Credit Score

Your credit score dramatically impacts the APR you’ll receive:

Excellent Credit (740+):

- Expected APR Range: 17%-21%

- Best Available: As low as 13.99% with top issuers

Good Credit (670-739):

- Expected APR Range: 21%-24%

- Aligns with market average of 21.39%

Fair Credit (580-669):

- Expected APR Range: 24%-28%

- Limited card options available

Poor Credit (Below 580):

- Expected APR Range: 28%-36%

- Subprime cards may charge maximum legal rates

WalletHub’s February 2026 analysis found:

- Discover: Lowest average low-end APR at 13.85%

- Capital One: Highest average low-end APR at 22.94%

- All major issuers: High-end APRs exceed 22%

Why Credit Card Rates Remain So High

Despite three Federal Reserve rate cuts in 2025, credit card APRs have actually increased rather than decreased. Several factors explain this counterintuitive situation:

Delayed Pass-Through: Credit card issuers historically reduce rates more slowly than they increase them. While rates shot up rapidly during 2022-2023 Fed hikes, reductions lag by months or quarters.

Risk-Based Pricing: Rising consumer debt levels and increasing delinquency rates in 2025 prompted issuers to maintain higher APRs as a buffer against potential defaults.

Profit Margins: Credit card companies earned record profits in 2024-2025. With consumers demonstrating willingness to pay high rates, issuers lack incentive to voluntarily reduce APRs.

New Customer Offers: The market averages include promotional rates for new customers with excellent credit. Existing account rates remain significantly higher.

Bankrate senior industry analyst Ted Rossman projects modest relief ahead: “The average credit card rate will fall a little more than half a percentage point in 2026. That means the average would only decrease to 19.1% by year’s end—which is still high and only 0.6% lower than the average rate at the end of 2025.”

The Real Cost of Credit Card Debt

To understand why credit card rates matter so dramatically, consider this calculation from Bankrate:

Example:

- Balance: $5,000

- Interest Rate: 20% APR

- Payment: Minimum payments only

- Result: 23 years to pay off, $7,723 in total interest paid

At today’s average rate of 23.79%, the situation worsens considerably. Someone with $7,000 in credit card debt paying $250/month would face:

- At 24.92% APR: 42 months to payoff, $3,594 in interest

- At 23.79% APR: 41 months to payoff, $3,314 in interest

- Savings: 1 month, $280 in interest

Even seemingly small rate reductions create meaningful savings over time.

0% APR Credit Cards: The Smart Alternative

For Americans carrying high-rate credit card debt, 0% introductory APR offers provide powerful relief:

Top 0% APR Offers (February 2026):

Citi Simplicity® Card:

- 0% APR for 21 months on balance transfers

- 0% APR for 12 months on purchases

- $0 annual fee

- Regular APR: 17.49%-28.24% Variable

- Balance transfer fee: 3% intro fee ($5 min) for first 4 months, then 5%

Wells Fargo Reflect® Card:

- 0% APR for 21 months on purchases

- 0% APR for 21 months on balance transfers

- $0 annual fee

- Regular APR: 18.24%-27.74% Variable

- Balance transfer fee: $5 or 3% (first 60 days), then 5%

U.S. Bank Shield™ Visa® Card:

- 0% APR for 24 months on purchases and balance transfers

- 4% cash back on prepaid air, hotel, car reservations

- $0 annual fee

- Regular APR: 16.99%-27.99% Variable

- Balance transfer fee: 5% ($5 min)

Chase Freedom Unlimited:

- 0% APR for 15 months on purchases and balance transfers

- 1.5% cash back on all purchases

- 5% cash back on travel through Chase

- $0 annual fee

Strategic Use of 0% APR Cards

Balance Transfer Strategy: If you have $10,000 in credit card debt at 24% APR, transferring to a 0% APR card for 21 months could save approximately $4,200 in interest charges—even after paying a 3% transfer fee ($300).

Required Actions:

- Calculate total debt and required monthly payment to pay off during 0% period

- Apply for 0% APR card (requires good-excellent credit)

- Transfer balances within promotional window (often 60-90 days)

- Set up automatic payments to avoid missing due dates (kills promo rate)

- Pay off balance before promotional period ends

Critical Warning: Missing even one payment typically voids the 0% promotional rate, immediately subjecting your entire balance to the regular APR (often 18%-28%). Set up autopay for at least the minimum payment.

Credit Cards with Permanently Low Rates

For those who need ongoing low rates rather than temporary 0% offers:

CoreFirst Bank & Trust Visa Platinum Card:

- Regular APR: 10.00% Variable

- Intro APR: 1.9% for 6 months

- $0 annual fee

- Comparison: 12.35% below market average

First Hawaiian Bank Heritage Credit Card:

- Intro APR: 2.99% for 8 months

- Regular APR: 18% Variable

- $0 annual fee

- Accepts applicants with limited credit history

These rare low-rate cards provide ongoing savings but typically offer no rewards programs.

Personal Loans 2026: The Middle Ground

Current Personal Loan Interest Rates

Personal loans occupy the middle ground between low-rate mortgages and high-cost credit cards, offering fixed rates and defined payoff timelines.

Average Personal Loan Rates (February 2026):

According to major tracking sources:

- Bankrate: 12.27% average APR (Feb 4, 2026)

- Federal Reserve: 11.65% average for 24-month bank loans

- Credit Unions: 10.64% average for 36-month loans

- Credible (Excellent Credit): 13.52% for 3-year loans, 18.21% for 5-year loans

Rate Ranges by Credit Score:

Excellent Credit (720+):

- Typical APR: 7%-12%

- Best Available: As low as 5.99%-6.49% with top lenders

- NerdWallet 2024 Data: 11.81% average for 720+ scores

Good Credit (670-719):

- Typical APR: 12%-18%

- Moderate risk pricing

Fair Credit (580-669):

- Typical APR: 18%-24%

- Limited lender options

Poor Credit (Below 580):

- Typical APR: 24%-36%

- Difficult to qualify; may require secured loans or cosigners

Top Personal Loan Lenders February 2026

Best Egg:

- APR Range: 5.99%-35.99%

- Loan Amounts: $2,000-$50,000

- Terms: 3 or 5 years

- Funding Speed: 1-3 business days

- Highlight: Lowest starting rate for secured personal loans

- Origination Fee: 0.99%-5.99%

LightStream:

- APR Range: 6.49%-25.49% (with AutoPay)

- Loan Amounts: $5,000-$100,000

- Terms: 2-7 years

- Funding Speed: Same day possible

- Highlight: No fees whatsoever (no origination, no prepayment penalty)

- Credit Required: Good to excellent

SoFi:

- APR Range: 8.99%-29.99%

- Loan Amounts: $5,000-$100,000

- Terms: 2-7 years

- Funding Speed: 1-7 business days

- Highlight: Unemployment protection, career coaching

- No origination fees

Upgrade:

- APR Range: 7.50%-35.97%

- Loan Amounts: $1,000-$50,000

- Terms: 2-7 years

- Funding Speed: 1-4 business days

- Highlight: Four APR discount opportunities

- Origination Fee: 1.85%-9.99%

- Accepts fair credit (580+ FICO)

Rocket Loans:

- APR Range: 7.161%-29.99%

- Loan Amounts: $2,000-$45,000

- Terms: 3 or 5 years only

- Funding Speed: Same day possible

- Highlight: Fastest funding available

- Origination Fee: 1%-6%

- Accepts fair credit

Personal Loan vs. Credit Card: When to Choose Which

Choose Personal Loan When:

- You need $5,000+ for a specific purpose

- You want a fixed payment and defined payoff date

- Your credit card APR exceeds 20%

- You’re consolidating multiple debts

- You need 2-7 years to repay

Choose Credit Card (0% APR) When:

- You can pay off balance within 15-21 months

- You need flexibility in payment amounts

- Amount needed is under $10,000

- You have excellent credit (for approval)

- You want to earn rewards while paying off debt

The Math: A $10,000 debt comparison:

Credit Card (20.97% APR):

- Paid over 2 years at $523/month

- Total Interest: $2,306

Personal Loan (12.27% APR):

- Paid over 2 years at $474/month

- Total Interest: $1,376

- Savings: $930 in interest, $49/month lower payment

Common Personal Loan Uses

Personal loans provide flexible funding for numerous purposes:

Debt Consolidation (Most Common):

- Combine multiple high-rate credit cards into single fixed payment

- Average American has $6,735 in credit card debt (Experian)

- Personal loan rates typically 8-12 percentage points lower than credit cards

Home Improvements:

- Kitchen/bathroom renovations

- Roof replacement

- HVAC system upgrades

- Alternative to home equity loans (no collateral risk)

Emergency Expenses:

- Major car repairs

- Unexpected medical bills

- Emergency home repairs

- Funeral expenses

Major Purchases:

- Wedding costs (average $30,000 in 2025)

- Vehicle purchase (alternative to dealer financing)

- Medical procedures not covered by insurance

Small Business Funding:

- Equipment purchases

- Inventory

- Cash flow gaps

- Alternative to business credit cards

What You CANNOT Use Personal Loans For:

- Home down payments (most lenders prohibit)

- Education expenses at accredited institutions (use student loans)

- Illegal activities

- Gambling or speculative investments

Personal Loan Approval Requirements

To qualify for competitive personal loan rates, lenders typically require:

Credit Score:

- Minimum: 580-620 (varies by lender)

- Competitive Rates: 670+

- Best Rates: 720+

Income:

- Stable, verifiable income source

- Debt-to-income ratio below 40%-50%

- Employment history of 2+ years preferred

Citizenship:

- U.S. citizen, permanent resident, or valid visa holder

- Valid Social Security number

Banking:

- Active checking/savings account

- Valid email address and phone number

Documentation:

- Recent pay stubs or tax returns

- Bank statements (2-3 months)

- Government-issued ID

Hidden Personal Loan Costs to Watch

Origination Fees:

- Range: 1%-10% of loan amount

- Subtracted from proceeds before you receive funds

- Example: Borrow $10,000 with 5% fee = receive $9,500, owe $10,000

- Many lenders charge zero origination fees (LightStream, SoFi, Discover)

Prepayment Penalties:

- Some lenders charge fees for early payoff

- Typically 2%-5% of remaining balance

- Look for “no prepayment penalty” lenders

Late Payment Fees:

- Usually $15-$39 per missed payment

- Can trigger default APR increase

- Damages credit score significantly

APR vs. Interest Rate:

- APR includes interest + fees

- Always compare APRs, not just interest rates

- A 10% rate with 5% origination fee = much higher effective APR

Smart Borrowing Strategies for 2026

Timing Your Mortgage Application

Best Time to Lock Mortgage Rate: Monitor rates daily through spring 2026. When you see rates drop 0.125%-0.25% below recent averages, consider locking. Rate locks typically last 30-60 days.

Spring Homebuying Season (March-June): Expect increased competition driving home prices up 5%-10%. However, more inventory becomes available, providing more choices.

Rate Lock Strategy:

- Get pre-approved before house hunting

- Lock rate when under contract on a home

- Consider float-down option (small fee allows one rate reduction if rates drop)

Credit Card Debt Payoff Strategies

Debt Avalanche Method:

- Pay minimums on all cards

- Put extra money toward highest-rate card

- Once paid off, attack next-highest rate

- Mathematically optimal—saves most money

Debt Snowball Method:

- Pay minimums on all cards

- Put extra money toward smallest balance

- Once paid off, attack next-smallest

- Psychologically rewarding—provides motivation through quick wins

Balance Transfer Strategy:

- Apply for 0% APR balance transfer card

- Transfer high-rate balances (pay 3%-5% fee)

- Pay off during 0% promotional period (15-24 months)

- Saves thousands in interest charges

Debt Consolidation Loan:

- Apply for personal loan at lower rate than credit cards

- Use proceeds to pay off all credit card balances

- Make single monthly payment on personal loan

- Simplifies payments, reduces total interest

Credit Score Optimization

Fast Credit Score Improvements (30-60 days):

- Pay down credit card balances below 30% of limits

- Become authorized user on someone’s old, well-managed account

- Dispute any errors on credit reports

- Pay all bills on time without exception

Long-Term Credit Building (6-12 months):

- Never use more than 30% of total available credit

- Keep old accounts open (length of history matters)

- Diversify credit mix (installment + revolving)

- Limit hard inquiries to 2-3 per year

Credit Score Impact Timeline:

- Missed payment: -60 to -110 points

- Credit utilization drop: +10 to +45 points

- New credit inquiry: -5 to -10 points

- Paying off collection: +10 to +30 points

Critical Warnings and Red Flags

Mortgage Red Flags

Avoid These Mortgage Mistakes:

Adjustable-Rate Mortgages (ARMs) in Rising Rate Environment: While ARMs offer lower initial rates (typically 0.5%-1% below fixed rates), they expose you to payment shock when rates adjust. With fixed rates already at reasonable levels (6.1%), the modest initial savings rarely justify the risk.

Interest-Only Loans: These allow you to pay only interest for initial period (5-10 years), building zero equity. When principal payments begin, monthly costs skyrocket. Suitable only for sophisticated investors, not primary residence buyers.

Stated Income/”No-Doc” Loans: These high-cost loans requiring no income verification carry rates 2%-4% above conventional mortgages. Predatory lenders target self-employed borrowers who could qualify for conventional loans with proper documentation.

Balloon Payment Mortgages: These require massive lump sum payment after 5-7 years. Unless you’re certain of refinancing ability or home sale, avoid entirely.

Credit Card Traps to Avoid

Minimum Payment Trap: Paying only minimums on $5,000 balance at 24% APR means:

- 23 years to pay off

- $7,723 in interest paid

- Total cost: $12,723

Always pay more than the minimum. Even $50 extra monthly saves thousands in interest and years of payments.

Cash Advance Disaster: Cash advances typically carry:

- 24.5%+ APR (no grace period—interest starts immediately)

- 3%-5% upfront fee

- Separate, higher APR than purchases

- Advances paid off last (after purchases)

Use personal loan or 0% credit card balance transfer instead.

Store Credit Cards: Retail cards often charge 28%-30% APR. Unless you pay in full monthly, the “20% discount” costs you far more in interest. Use 0% APR cards or personal loans instead.

Closing Old Accounts: Closing credit cards reduces total available credit, increasing your credit utilization ratio and potentially dropping your score 20-50 points. Keep old accounts open with small recurring charge.

Personal Loan Scams

Advance Fee Scams: Legitimate lenders never require upfront fees before approving loans. Any lender demanding “processing fees” or “insurance” before approval is a scam. Report to FTC immediately.

Guaranteed Approval Claims: No legitimate lender guarantees approval regardless of credit. Claims of “guaranteed approval” or “no credit check” signal predatory lending or outright fraud.

Pressure Tactics: Legitimate lenders provide time to review terms. High-pressure tactics (“This rate expires in one hour!”) indicate scams. Walk away immediately.

Unsecured Lenders Requesting Collateral: If applying for unsecured personal loan, lender should never ask for car titles, home deeds, or other collateral. This indicates bait-and-switch scheme.

The Bottom Line: Making Smart Decisions

The borrowing landscape in February 2026 offers both opportunities and pitfalls for American consumers:

Mortgages: With rates at multi-year lows around 6.1%, conditions favor both buyers and refinancers. Spring homebuying season approaches—pre-approval now positions you to act when you find the right property.

Credit Cards: At nearly 24% average APR, carrying balances is extraordinarily expensive. Prioritize paying off high-rate cards using 0% balance transfers, debt consolidation loans, or aggressive payment strategies.

Personal Loans: At 12.27% average APR, personal loans provide middle-ground financing for debt consolidation, home improvements, or emergency expenses. Shop multiple lenders—rates vary dramatically based on credit score and lender.

Universal Truth: Your credit score is your most valuable financial asset. A 100-point credit score improvement can save you $50,000-$100,000 over a lifetime of borrowing. Invest time in building and maintaining excellent credit.

Whether you’re buying your first home, consolidating debt, or financing a major purchase, understanding current rates and smart borrowing strategies empowers you to make decisions saving thousands of dollars. In 2026’s complex lending environment, knowledge truly is money.

In 2026’s complex lending environment, knowledge truly is money. Use the tools, strategies, and warnings in this guide to navigate the borrowing landscape successfully, avoid predatory lenders, and build the financial foundation for long-term prosperity.

The difference between a 6% mortgage and 7% mortgage on a $400,000 home is $107,000 over 30 years. The difference between paying 24% on credit cards versus consolidating at 12% on a personal loan could save $15,000 on a $25,000 balance. These aren’t small numbers—they’re life-changing amounts of money.

Make informed decisions. Shop aggressively for the best rates. Read every word of loan documents. Build and protect your credit score. And never, ever borrow more than you can comfortably repay.

Your financial future depends on the borrowing decisions you make today.

Social Connect: