SpaceX IPO Could Launch in June 2026: Musk Eyes $1.5 Trillion Valuation Aligned with Planetary Conjunction

Elon Musk’s SpaceX is reportedly planning a historic initial public offering in mid-June 2026, potentially coinciding with a rare celestial event and the billionaire’s 55th birthday. The move could catapult the space technology company to a $1.5 trillion valuation, making it the largest IPO in history while potentially pushing Musk across the trillionaire threshold.

Breaking: Wall Street Banks Line Up for Biggest IPO Ever

SpaceX is lining up four major Wall Street investment banks to lead what could become the largest initial public offering in U.S. history, according to reports from the Financial Times and Reuters. The aerospace manufacturer, valued at approximately $800 billion in a December 2025 secondary share sale, is targeting a valuation of $1.5 trillion when it goes public — nearly double its current private market price.

The proposed $1.5 trillion IPO would shatter the previous record set by Saudi Aramco’s $1.7 trillion listing in 2019, though Aramco’s actual fundraising was smaller. SpaceX CFO Bret Johnsen has reportedly been holding meetings with private investors since mid-December as preparations continue, signaling that the long-anticipated public debut is closer than ever.

The Cosmic Timing: Why June 2026?

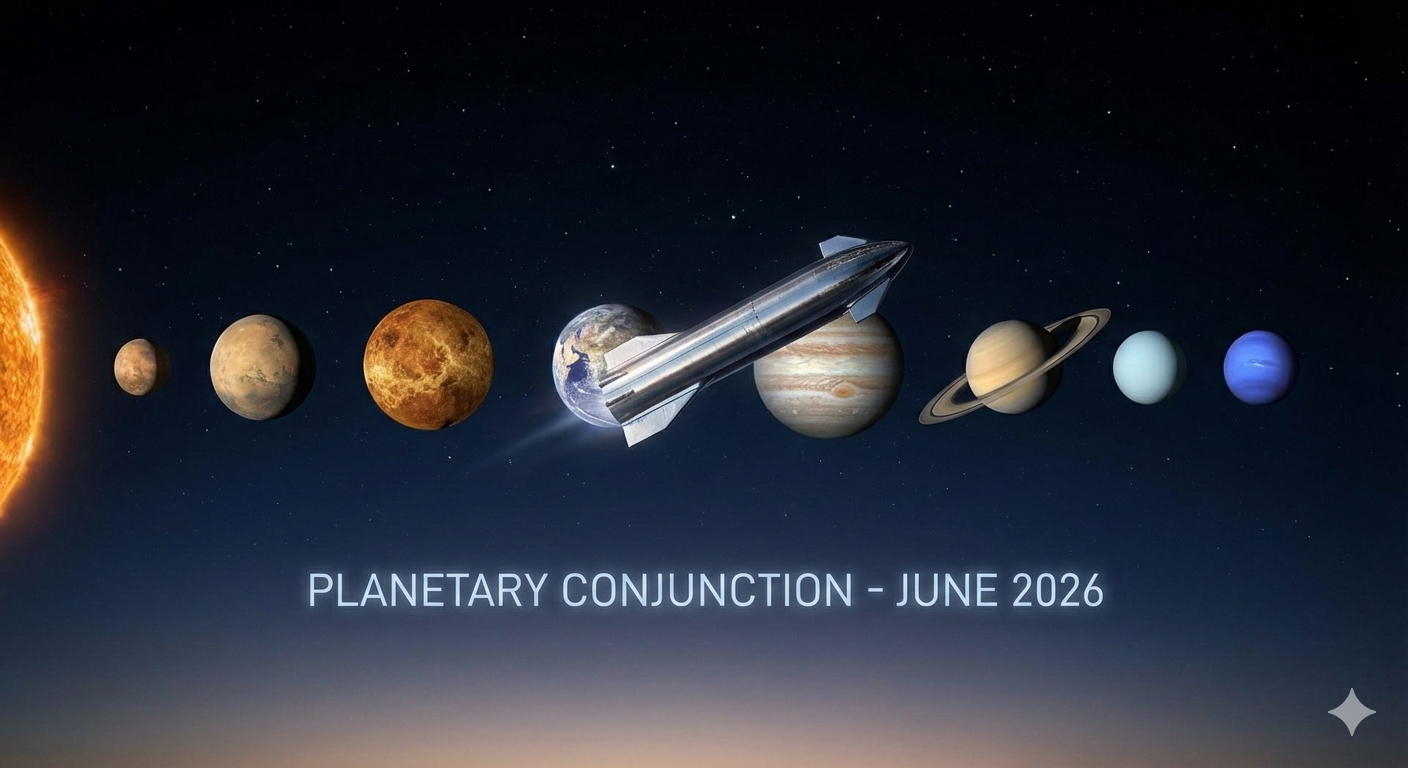

In a characteristically bold move, Elon Musk is reportedly considering timing the SpaceX IPO to coincide with a spectacular astronomical event. On June 8 and 9, 2026, Jupiter and Venus will appear to align in the night sky in what astronomers call a conjunction — appearing as close as “the width of a thumb held at arm’s length,” according to The Planetary Society.

A Rare Celestial Spectacle

This will be the first time in over three years that Jupiter and Venus will appear this close together in the evening sky. Days after the conjunction, Mercury will also align diagonally with both planets, creating a triple planetary alignment visible to observers across the Northern Hemisphere.

Sources familiar with the matter told the Financial Times that Musk himself is behind the proposed timing of the $50 billion offering, seeking to leverage the unique space event to generate additional attention for the space sector and the historic public listing.

Musk’s 55th Birthday and the Trillion-Dollar Milestone

Another compelling reason for the June timing is Elon Musk’s birthday on June 28. At 55 years old, Musk could become the world’s first trillionaire if SpaceX achieves its targeted $1.5 trillion valuation. Currently worth between $690 billion and $748 billion according to Bloomberg and Forbes respectively, Musk owns approximately 42% of SpaceX, giving him significant upside from the public listing.

Why SpaceX Is Going Public Now

For years, Elon Musk resisted taking SpaceX public, arguing that quarterly earnings pressures would conflict with his long-term vision of making humanity a multiplanetary species. However, the company’s shifting priorities and ambitious projects have necessitated unprecedented capital requirements.

The Space Data Center Revolution

SpaceX’s IPO is expected to raise between $30 billion and $50 billion, with much of the capital earmarked for developing orbital data centers. These space-based facilities would harness solar energy to process, store, and transmit data — essentially creating a network of satellites that perform the functions of Earth-based data centers.

Industry analysts believe this infrastructure could support the artificial intelligence boom, as tech giants like Google and OpenAI explore ways to overcome Earth’s energy constraints. Deutsche Bank analyst Edison Yu noted that while technical challenges exist, “these seem to be engineering constraints as opposed to physics,” suggesting the concept is viable.

Funding the Mars Vision

While some SpaceX purists worry that going public could dilute the company’s Mars colonization mission, others argue that the capital infusion is essential for achieving Musk’s interplanetary goals. The company’s Starship program — currently undergoing test flights in South Texas — requires billions in development funding to become fully operational.

How Investors Can Get Exposure to SpaceX IPO

For retail and institutional investors eager to participate in the SpaceX IPO, several avenues currently exist to gain indirect exposure, with more direct options likely becoming available as the public listing approaches.

Current Pre-IPO Investment Options

Before the IPO, investors have limited but growing options for SpaceX exposure. Public companies holding stakes in the private space giant include Alphabet Inc. (NASDAQ: GOOGL), Bank of America (NYSE: BAC), and EchoStar Corporation (NASDAQ: SATS). These positions provide indirect exposure to SpaceX’s growth trajectory.

Two specialized investment vehicles offer more direct access: the Destiny Tech 100 Inc. (NYSE: DXYZ) and the ERShares Private-Public Crossover ETF (NASDAQ: XOVR), both of which maintain exposure through special purpose vehicles (SPVs). Additionally, the ARK Venture Fund, available through retail platforms like SoFi, holds a significant SpaceX stake.

Select Fidelity mutual funds also provide SpaceX exposure for investors with access to those products.

Tesla Investors May Get First Access

Elon Musk has previously stated his preference to offer SpaceX IPO access to Tesla Inc. (NASDAQ: TSLA) shareholders first. This remains the top shareholder question for Tesla, and investors are closely watching for any official announcements about preferential access rights.

The potential for cross-company integration is significant. Musk has discussed possibilities for xAI (his artificial intelligence company) to merge with or integrate into SpaceX before the IPO, creating a unified ecosystem spanning electric vehicles, space infrastructure, and frontier AI models.

Broader Space Sector Exposure

Strong demand for the SpaceX IPO could ignite renewed interest in space stocks across the sector, potentially increasing valuations industry-wide. The Procure Space ETF (NASDAQ: UFO) offers pure-play exposure to the space sector and could benefit significantly from increased attention surrounding the SpaceX public debut.

Secondary Market Signals Strong Demand

While preparations for the IPO continue, SpaceX shares are trading briskly in the secondary market, with prices already approaching the proposed trillion-dollar-plus IPO valuation. Greg Martin, managing director at Rainmaker Securities, reports significant uptick in both transaction size and pricing on secondary platforms.

“SpaceX has continued to defy gravity,” Martin told industry observers. “Even during the down periods of ’22 and ’23, SpaceX was the one company that continued to price up every time there was a hint of the company going public.”

The robust secondary market activity suggests institutional and accredited investors are positioning themselves ahead of the public listing, viewing the IPO as a potential “bellwether” event that could reopen the IPO market after a prolonged drought since 2021.

SpaceX’s Stellar Performance Justifies Premium Valuation

SpaceX’s operational achievements underscore why investors are willing to pay premium valuations. The 23-year-old company launched more rockets in 2025 than the rest of the world combined, cementing its position as NASA’s leading contractor and the dominant player in commercial space launch services.

Starlink: The Cash-Flow Engine

The company’s Starlink satellite internet service has evolved into a significant revenue generator, providing the stable cash flow that makes an IPO feasible. With thousands of satellites already in orbit and millions of subscribers worldwide, Starlink represents a defensible competitive moat that public market investors typically reward with premium multiples.

Revolutionary Reusable Rocket Technology

SpaceX’s pioneering work on reusable rockets — particularly the Falcon 9 booster, which has now achieved over 150 successful landings and re-launches — has fundamentally reduced the cost of space access. This technological advantage, combined with the company’s vertical integration and manufacturing efficiency, creates substantial barriers to entry for competitors.

Is the $1.5 Trillion Valuation Justified?

Market analysts are divided on whether SpaceX’s proposed $1.5 trillion valuation can be justified by its current financial performance. At nearly 70 times annual sales, the valuation implies extraordinary growth expectations that hinge on successful execution of ambitious projects like space-based data centers and Mars missions.

However, supporters argue that SpaceX represents a unique combination of proven revenue generation (through launch services and Starlink), technological leadership (reusable rockets), and transformative future potential (space infrastructure and interplanetary travel). This blend of present profitability and moonshot ambitions could command premium valuations in a market hungry for growth stories.

Baron Capital’s Ron Baron, whose firm holds SpaceX as one of its largest positions, has approximately a quarter of his personal investments in the company — a powerful vote of confidence from a respected institutional investor.

The AI Connection: Musk’s Broader Strategy

Industry observers believe the SpaceX IPO may be part of Elon Musk’s broader strategy to win the artificial intelligence race. With Microsoft pouring $13 billion into OpenAI and Amazon reportedly in talks to invest $50 billion in the AI startup, Musk faces well-funded competitors in the AI sector.

A successful SpaceX IPO raising $50-100 billion could provide Musk with the capital firepower needed to accelerate xAI development and potentially integrate AI capabilities with SpaceX’s planned orbital infrastructure. Some analysts speculate that xAI could merge with SpaceX before the IPO, creating a unified platform for frontier AI models and space-based computing infrastructure.

Tesla’s recent strategic moves — including $2 billion in xAI investments and increased focus on Optimus robots and autonomous driving — appear coordinated with SpaceX’s trajectory, suggesting a grand strategy to consolidate Musk’s AI ambitions under one funding umbrella.

IPO Could Reopen Markets After Years-Long Drought

The U.S. IPO market has been largely dormant since 2021, with risk-averse investors and volatile market conditions keeping many companies private longer than planned. A successful SpaceX IPO could serve as the catalyst that reopens public markets for other high-profile private companies.

Companies like ByteDance, Stripe, Databricks, OpenAI, and Anthropic are all watching the SpaceX situation closely. If Musk’s space venture commands the premium valuation it’s targeting, it could create a “halo effect” that encourages other unicorns to test public markets.

According to prediction markets on Polymarket, traders assign an 80% probability to a SpaceX IPO occurring by December 2027, with 73.5% betting on a day-one valuation exceeding $1 trillion — suggesting strong market confidence in the offering’s success.

Risks Investors Should Consider

Despite the excitement surrounding the SpaceX IPO, investors should carefully evaluate several risk factors before committing capital to what would be the largest public offering in history.

Elon Musk Concentration Risk

Much of SpaceX’s value is inextricably linked to Elon Musk’s vision and leadership. As one analyst noted, “When you put so much value in the belief that one person can exceed expectations continuously, that’s a big challenge.” Musk’s demanding schedule across multiple companies — Tesla, SpaceX, xAI, X (formerly Twitter), Neuralink, and The Boring Company — raises questions about focus and execution capacity.

Ambitious Technology Challenges

The space data center concept, while theoretically sound, remains unproven at commercial scale. Similarly, the Mars colonization mission — while inspirational — faces enormous technical, financial, and regulatory hurdles that could take decades to overcome. Investors betting on these moonshot projects must be prepared for extended development timelines and potential setbacks.

Regulatory and Political Considerations

As a major government contractor with over $20 billion in federal contracts as of late 2024, SpaceX operates in a highly regulated environment subject to political winds and policy changes. Any shift in government space policy or contract awards could materially impact the company’s revenue and growth trajectory.

Key Milestones to Watch Before the IPO

As SpaceX moves toward its historic public debut, several key developments will shape investor sentiment and ultimate valuation:

Starship Test Flights: Successful orbital launches and landing demonstrations of the Starship system will be critical for validating SpaceX’s technological roadmap and Mars ambitions.

Starlink Growth Metrics: Subscriber numbers, revenue growth, and path to profitability for the satellite internet business will heavily influence valuation multiples.

Space Data Center Progress: Any concrete developments or partnerships around orbital computing infrastructure could validate the company’s most ambitious growth thesis.

xAI Integration: Clarity on whether xAI will merge with SpaceX before the IPO, and how such a combination would be structured and valued.

Tesla Investor Access: Official announcements about preferential access for Tesla shareholders, which could drive significant demand.

The Bottom Line: A Historic Moment for Space Investing

The potential June 2026 SpaceX IPO represents a watershed moment for the space industry and public markets. If successful at the $1.5 trillion valuation, it would not only be the largest IPO in history but also validate the commercial viability of ambitious space ventures beyond traditional satellite and launch services.

For Elon Musk, the offering could provide the capital ammunition needed to pursue his dual visions of making humanity multiplanetary while winning the artificial intelligence race. For investors, it offers a chance to participate in one of the decade’s most transformative companies — though at a valuation that leaves little room for execution stumbles.

As the planets align in June 2026, all eyes will be on SpaceX to see if it can deliver on the astronomical expectations priced into its historic public debut. Whether the timing proves cosmically fortuitous or merely cosmic marketing remains to be seen.

Disclaimer: This article is for informational purposes only and should not be construed as investment advice. Readers should conduct their own research and consult with financial advisors before making investment decisions.

Social Connect :

Related Article :

Doomsday Clock Reaches 85 Seconds to Midnight: Humanity Faces Closest Point to Extinction in History