Treasury Holds Auction Sizes Steady in $125B Refunding — But Dealer Survey Reveals Looming $1.1 Trillion Funding Gap

The U.S. Treasury Department announced Wednesday it will maintain current auction sizes for government notes and bonds for at least the next several quarters, unveiling a $125 billion quarterly refunding that will raise $34.8 billion in new cash from private investors. While the announcement was broadly expected by markets, newly released minutes from the Treasury Borrowing Advisory Committee exposed a far more concerning reality: primary dealers are forecasting a $1.1 trillion funding shortfall in fiscal years 2027-2028 if auction sizes remain at current levels.

LATEST UPDATE (Feb. 4, 2026): Treasury officials confirmed they do not anticipate increasing coupon or floating rate note auction sizes for “at least the next several quarters.” However, the TBAC meeting minutes released this morning revealed primary dealers have dramatically reduced their aggregate privately-held marketable borrowing estimates by $258 billion for FY2026-28, yet still project a massive funding gap ahead. Meanwhile, tariff revenue has surged 315% in Q1 FY2026, partially offsetting declines in corporate tax receipts due to accelerated expensing provisions in recent legislation.

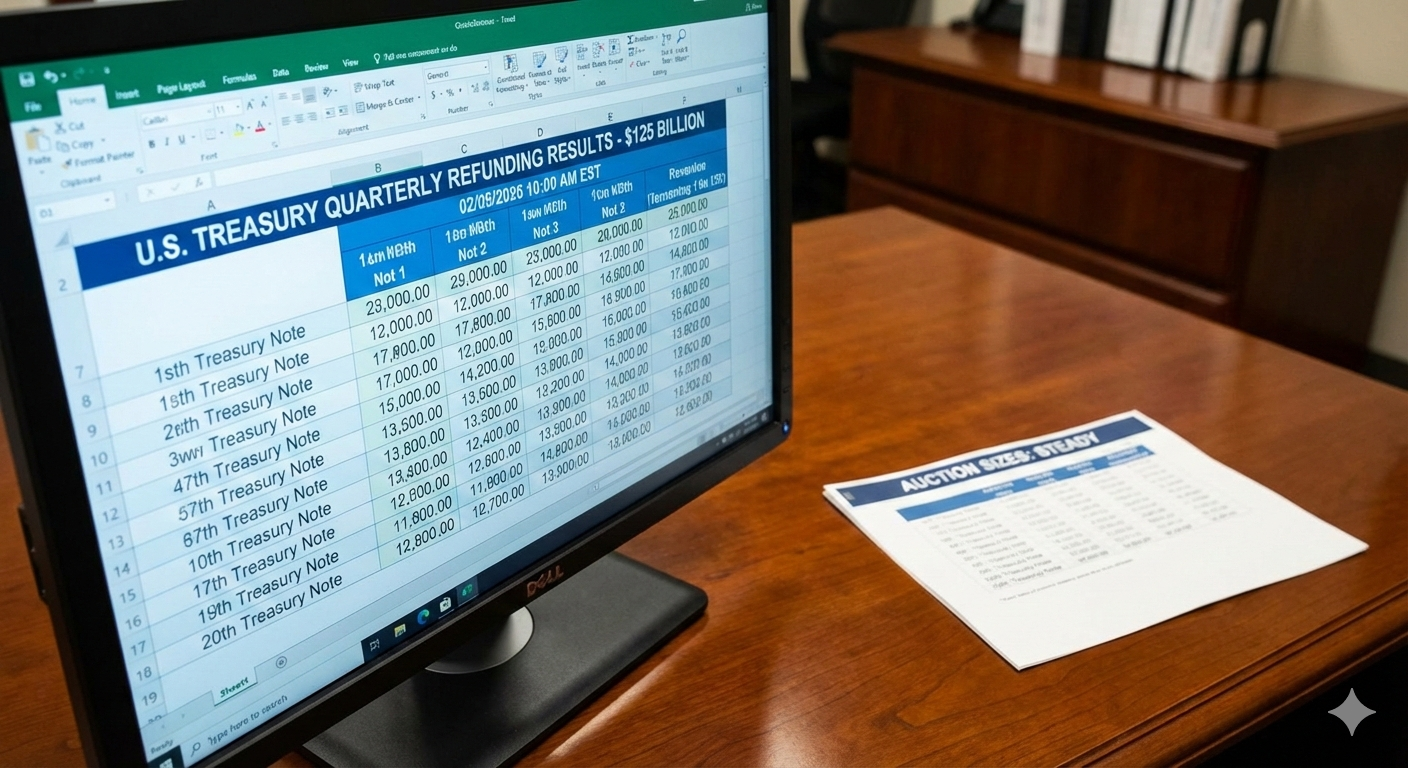

Treasury Announces February-April Refunding Details

In its quarterly refunding announcement Wednesday, the U.S. Treasury Department outlined plans to sell $125 billion in Treasury securities to refund approximately $90.2 billion of privately-held Treasury notes and bonds maturing on February 15, 2026. The issuance will raise new cash from private investors of approximately $34.8 billion, according to Deputy Assistant Secretary for Federal Finance Brian Smith.

The three securities to be auctioned next week include a $58 billion 3-year note maturing February 15, 2029, a $42 billion 10-year note maturing February 15, 2036, and a $25 billion 30-year bond maturing February 15, 2056.

Auction Schedule and Settlement Details

All three auctions will be conducted on a yield basis at 1:00 p.m. Eastern Time:

- Tuesday, February 10: $58 billion 3-year note auction

- Wednesday, February 11: $42 billion 10-year note auction

- Thursday, February 12: $25 billion 30-year bond auction

All auctions will settle on Tuesday, February 17, 2026.

| SECURITY TYPE | AUCTION SIZE | MATURITY DATE | AUCTION DATE |

|---|---|---|---|

| 3-Year Note | $58 billion | February 15, 2029 | February 10, 2026 |

| 10-Year Note | $42 billion | February 15, 2036 | February 11, 2026 |

| 30-Year Bond | $25 billion | February 15, 2056 | February 12, 2026 |

Auction Sizes Remain Unchanged — For Now

In its official statement, the Treasury Department said it plans to maintain nominal coupon and Floating Rate Note auction sizes for at least the next several quarters. The announcement was in line with market expectations and drew little immediate reaction from Treasury markets, where yields on benchmark securities moved modestly higher following the release.

Treasury Inflation-Protected Securities (TIPS) auction sizes will also remain at current levels for the February to April 2026 quarter, according to the announcement.

Bill Supply to Decline Sharply in Spring

For Treasury bill issuance, the department expects to maintain offering sizes of benchmark bills at or near current levels into mid-March before incrementally reducing short-dated bill auction sizes in light of the April 15 tax date. These reductions will likely lead to a cumulative $250-300 billion net decline in total bill supply by early May, the Treasury said.

The Treasury estimates that the size of the Treasury General Account could peak around $1.025 trillion (plus or minus $50 billion) by late April, before declining in May, assuming an $850 billion cash balance at the end of March.

The Troubling Forecast Hidden in TBAC Minutes

While the Treasury’s public announcement presented a steady-as-she-goes picture, the Treasury Borrowing Advisory Committee meeting minutes released Wednesday morning told a far more complex story about America’s fiscal future.

According to the TBAC minutes, primary dealers — the elite group of financial institutions authorized to trade directly with the Federal Reserve and required to bid at Treasury auctions — have reduced their aggregate FY2026-28 privately-held marketable borrowing estimate by $258 billion since the previous quarter. That sounds like good news on its face, suggesting lower borrowing needs than previously anticipated.

The Critical Finding

However, the minutes contain a stark warning: “The median primary dealer forecast for privately-held net marketable borrowing implies a $1.1 trillion funding shortfall in FY2027-28 based on current coupon auction sizes and bill supply.”

In plain English, this means that even with the reduced borrowing estimates, the Treasury Department will need to raise $1.1 trillion more than it can generate from current auction sizes over the next two fiscal years. This shortfall will require either significantly larger auction sizes, dramatic cuts to federal spending, substantial increases in tax revenue, or some combination of all three.

What Primary Dealers Are Seeing

Treasury Director of the Office of Debt Management Fred Pietrangeli noted during the TBAC meeting that the latest dealer estimates show that, at current issuance sizes, Treasury is slightly overfunded in FY2026. The problem emerges in fiscal years 2027 and 2028, when the government’s borrowing needs are projected to surge well beyond what current auction levels can accommodate.

Deputy Director Tom Katzenbach reviewed primary dealers’ expectations for coupon issuance, noting that the consensus remains that current coupon auction sizes leave Treasury well-positioned to meet projected financing needs through FY2026. The implication is clear: changes are coming, just not immediately.

Tariff Revenue Surge Masks Deeper Fiscal Challenges

One reason the Treasury can afford to hold auction sizes steady for now is a massive surge in tariff revenue resulting from the Trump administration’s aggressive trade policies. Treasury Director of the Office of Fiscal Projections Nick Steele highlighted changes in receipts and outlays during Q1 FY2026 that paint a nuanced picture of federal finances.

Revenue Winners and Losers

Within receipts, Steele emphasized a stunning 315% increase (or $71 billion) in customs deposits reflecting higher tariff revenue from the administration’s expanded tariff regime. Individual income tax collections also grew robustly, with withheld taxes up $47 billion and non-withheld taxes up $45 billion.

However, these gains were partially offset by a sharp 23% decline (or $27 billion) in corporate tax receipts. Treasury officials attributed this drop to corporate tax provisions in recent legislation that allow for accelerated expensing and depreciation, enabling companies to take larger deductions in 2025.

Spending Side of the Equation

On the outlay side, the largest increase occurred at the Treasury Department itself, which rose by 13% (or $48 billion), primarily due to interest payments on the public debt. This reflects the ongoing challenge of servicing a growing national debt in a higher interest rate environment.

Meanwhile, Department of Education outlays decreased by 26% (or $11 billion), while a group of other outlays fell by 64% (or $68 billion), primarily due to reduced disbursements by the Environmental Protection Agency and the Federal Emergency Management Agency.

What Wall Street Is Saying

Bond market analysts responded cautiously to Wednesday’s announcements, noting that the lack of auction size increases was expected but that the longer-term funding gap revealed in the TBAC minutes raises serious questions about future Treasury market dynamics.

“The fact that Treasury is comfortable holding sizes steady tells us they believe the fiscal picture for the next few quarters is manageable. But that $1.1 trillion shortfall in ’27-’28 is the elephant in the room that everyone is trying not to look at directly.”

Several strategists noted that the Treasury’s decision-making appears heavily influenced by the tariff revenue windfall, which has provided unexpected fiscal breathing room. However, they cautioned that tariff revenue can be volatile and may not prove sustainable if trade negotiations lead to tariff reductions or if import volumes decline in response to higher costs.

Market Reaction Muted

Treasury yields moved modestly higher following the announcements, with the 10-year note yield rising approximately 3 basis points to 4.58%, while the 30-year bond yield increased 4 basis points to 4.78%. The 2-year note yield ticked up 2 basis points to 4.32%.

The relatively subdued market reaction suggests investors had largely priced in the expectation that auction sizes would remain unchanged in the near term. However, bond market volatility could increase as fiscal year 2027 approaches and the Treasury is forced to address the looming funding gap.

Treasury Buyback Program Continues

In addition to the refunding announcement, the Treasury outlined plans for its securities buyback program during the upcoming quarter. The department plans to purchase up to $38 billion in off-the-run securities for liquidity support and up to $75 billion in the 1-month to 2-year maturity bucket for cash management purposes.

New Counterparty Access Coming

On January 14, 2026, the Treasury released a notice of proposed rulemaking regarding plans to offer direct buyback access to additional counterparties based on their participation in Treasury auctions. The comment period closes on February 13, 2026.

Treasury officials indicated that in the coming months, the department expects to transition its buyback operations to the Federal Reserve Bank of New York’s new trading platform, FedTrade Plus, and plans to conduct a small-value test buyback to support this transition.

The Longer-Term Fiscal Picture

The primary dealer forecasts revealed in the TBAC minutes align with broader concerns about America’s fiscal trajectory that have been raised by the Congressional Budget Office, the Office of Management and Budget, and independent economic analysts.

Deficit Projections Continue to Climb

The median primary dealer estimate for the federal deficit in fiscal year 2027 has increased notably compared to official estimates from OMB and CBO, driving higher forecasts of privately-held net marketable borrowing. While primary dealers reduced their near-term borrowing estimates by $258 billion for the FY2026-28 period, the absolute borrowing needs remain extraordinarily high by historical standards.

The structural drivers of growing deficits remain firmly in place: an aging population increasing spending on Social Security and Medicare, rising interest costs on a ballooning national debt, and a tax code that generates revenues averaging around 18% of GDP while spending consistently runs above 23% of GDP.

Interest Cost Time Bomb

Perhaps the most concerning element of the fiscal outlook is the rapid growth in interest payments. As noted in the TBAC discussion, Treasury Department outlays rose 13% primarily due to interest on the public debt. With the national debt now exceeding $36 trillion and interest rates significantly higher than the ultra-low levels of the 2010s, net interest costs are consuming an ever-larger share of federal revenues.

If interest rates remain elevated and the debt continues growing at current rates, net interest could become the single largest category of federal spending within the next decade, crowding out funding for defense, infrastructure, education, and other national priorities.

What Happens When Auction Sizes Must Increase?

The $1.1 trillion funding shortfall projected for FY2027-28 will eventually force the Treasury Department to take action. When that time comes, the most likely response will be significant increases in auction sizes across the maturity spectrum.

Potential Market Impacts

Increasing auction sizes substantially could have several effects on Treasury markets:

- Higher yields: Flooding the market with additional supply typically requires higher yields to attract sufficient investor demand

- Increased volatility: Larger auction sizes can lead to more pronounced price swings around auction dates

- Crowding out effect: Higher Treasury yields could make borrowing more expensive for corporations, consumers, and state/local governments

- Dollar strength: Higher U.S. yields could attract foreign capital, potentially strengthening the dollar but hurting U.S. exporters

- Fed policy constraints: Rising Treasury yields could complicate Federal Reserve monetary policy decisions

Alternative Scenarios

While increasing auction sizes is the most straightforward solution to the funding gap, other possibilities exist:

Spending cuts: Congress could enact significant reductions to federal spending, though political gridlock makes major deficit reduction efforts extremely difficult.

Tax increases: Lawmakers could raise revenues through tax increases or by allowing certain tax cuts to expire, though this faces similar political obstacles.

Economic growth: Stronger-than-expected economic growth could boost tax revenues and reduce the borrowing needs, though primary dealers have already factored baseline growth assumptions into their forecasts.

Inflation: Higher inflation would reduce the real value of the debt but would also likely force the Federal Reserve to maintain higher interest rates, increasing borrowing costs.

Congressional Response and Political Implications

The Treasury’s announcements come as Congress grapples with competing fiscal priorities and deep partisan divisions over budget policy. Republicans generally favor extending and expanding the 2017 tax cuts, which would increase deficits but which they argue would stimulate economic growth. Democrats have called for allowing some tax cuts for high earners to expire while increasing spending on social programs and infrastructure.

Neither party has shown much appetite for the kind of fiscal restraint that would be necessary to close the projected $1.1 trillion funding gap without dramatically increasing auction sizes.

Debt Ceiling Complications Ahead

The funding shortfall could also complicate future debt ceiling negotiations. While the current debt limit suspension remains in effect through 2026, lawmakers will eventually need to address the statutory borrowing limit. The projected surge in borrowing needs for FY2027-28 could make those negotiations even more contentious than usual.

What Investors Need to Know

For investors in Treasury securities and those who follow bond markets, several key takeaways emerge from Wednesday’s announcements:

Key Investment Implications

- Near-term stability: Auction sizes will remain steady for at least the next several quarters, providing predictability for Treasury market participants

- Mid-term uncertainty: The $1.1 trillion funding gap for FY2027-28 creates significant uncertainty about future auction sizes and yields

- Bill supply decline: Treasury bill supply will decline by $250-300 billion by early May, potentially affecting money market dynamics

- Tariff revenue volatility: The current fiscal breathing room depends heavily on tariff revenues that could prove temporary

- Long-term fiscal concerns: Structural deficits and rising interest costs point to sustained upward pressure on Treasury yields over time

Looking Ahead: The May Quarterly Refunding

The next quarterly refunding announcement is scheduled for May 4, 2026. By that time, Treasury officials will have better visibility into the full-year fiscal picture for FY2026 and may provide additional guidance on how they plan to address the funding shortfall projected for fiscal years 2027 and 2028.

Market participants will be watching closely for any signals that the Treasury is preparing to increase auction sizes, either through explicit announcements or through changes to the language in quarterly refunding statements. The TBAC minutes from the May meeting will be particularly important for understanding how primary dealers’ deficit forecasts evolve as more economic data becomes available.

Bottom Line

Wednesday’s Treasury announcements delivered the expected news that auction sizes will remain unchanged in the near term. But beneath that surface stability lies a more troubling reality: the federal government faces a massive and growing funding gap that will eventually require difficult choices about borrowing, spending, and taxation.

The $1.1 trillion shortfall projected by primary dealers for FY2027-28 represents just the beginning of what many economists view as a long-term fiscal sustainability crisis. Without significant policy changes, the Treasury Department will be forced to flood the market with new debt issuance in coming years, with potentially significant implications for interest rates, economic growth, and financial market stability.

For now, the combination of surging tariff revenues and slightly reduced deficit estimates has bought Treasury officials some breathing room. But as the fiscal calendar advances toward 2027, the day of reckoning for America’s fiscal policy is drawing ever closer.

Social Connect: